* Asian banks lack capacity to fill in gap left by Europeans

* Low global interest rates may create property bubble in Asia

* MAS takes steps to boost Sing dollar corp bond liquidity (Recasts on impact of reduced European bank lending)

SINGAPORE, March 14 (Reuters) – European banks will continue to reduce their lending in Asia, posing problems for companies in the region as local financial institutions lack the capacity to make up the shortfall, Singapore’s central bank chief warned on Wednesday.

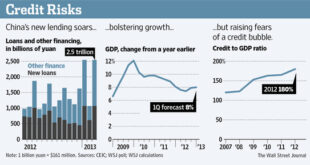

Asian firms, other than the bluest of blue chips, have seen a jump in their dollar borrowing costs as European lenders retreat and some analysts say the shortage of dollars may result in a spike in emerging market defaults as firms struggle to roll over maturing loans and bonds.

“Deleveraging by Eurozone banks is far from over (and) the capacity of Asian banks to fill the trade financing gap is limited,” Monetary Authority of Singapore (MAS) managing director Ravi Menon said at an investment conference, but he added that the impact so far had been limited.

He said European banks provide 36 percent of global trade finance loans, and that in Asia, French and Spanish banks together account for more than two-fifths.

Asian banks may also become more selective about the risks they want to take, given the uncertain global outlook, and they may be constrained by counterparty limits from taking over the trade finance lines of their much-larger European counterparts, he added.

“The U.S. dollar loan-to-deposit ratios of Asia ex-Japan banks are already at elevated levels and could be a constraint,” he said.

In Singapore, Asian banks’ market share of export bills for Singapore-originated trade activities rose to 55 percent in the last quarter of 2011 from 36 percent before the financial crisis, according to Menon.

RISKS FOR REAL ESTATE, BONDS

Menon also said an unprecedented loosening of monetary policy by central banks in the United States, Britain and Eurozone could result in disruptive capital flows and inflation in Asia.

“Persistent low real interest rates can distort savings-investment decisions and lead to a misallocation of resources. Risks may build up in specific sectors, like real estate for instance,” he said.

MAS on Wednesday also announced new measures to boost liquidity in Singapore dollar-denominated corporate bonds in a bid to further develop the city-state’s financial markets.

The Singapore central bank said it will provide swap liquidity to primary dealer banks handling Singapore dollar-denominated debt issuance for foreign companies to reduce uncertainty in pricing.

It will also help create a Singapore dollar corporate debt securities lending facility and introduce a price discovery platform where participants will contribute end-of-day prices for Singapore dollar corporate bonds.

Source: Reuters

Asia Finance News Asia finance news, banking, market analysis, business, Forex, trade, Cryptocurrency as it is happening in Asia. Trusted gateway for Asian financial news.

Asia Finance News Asia finance news, banking, market analysis, business, Forex, trade, Cryptocurrency as it is happening in Asia. Trusted gateway for Asian financial news.