In late 2012, the Rocky Mountain Institute’s cofounder, chairman, and chief scientist Amory Lovins spent seven weeks in Japan, China, India, Indonesia, and Singapore observing Asia’s emerging green energy revolution. In February 2013, he returned to Japan and China. Japan, China, and India—all vulnerable to climate change—turned out to be in different stages of a “shared and massive shift” to a green energy future, one with remarkable similarities to RMI’s Reinventing Fire vision for the United States

India Starts Tipping

So what about the country that—together with China—is responsible for 76 percent of the world’s planned 1.4 trillion watts of coal-fired power plants and 90 percent of the projected growth in global coal demand to 2016; that plans (implausibly) to build a coal-fired plant fleet twice as big as America’s; and that will ultimately surpass China in population, though one-fourth of its people still lack electricity?

India’s power generation is still mainly coal-fired, but India’s coal is only abundant, not cheap. Chronic coal-sector and logistics challenges have created growing import dependence (as in China, which became a net importer in 2009). That helped the six countries that control four-fifths of global coal exports to gain the market power to boost prices, so they did. Rising coal imports and a weakening currency gave India a macroeconomic headache and power producers a financial migraine.

Coal prices 2–3 times assumptions imposed a grave price/cost squeeze on two of the world’s biggest coal plants—4-GW projects owned by the largest generating firm (Tata Power, part of Tata Group that’s nearly 5 percent of India’s GDP) and by Reliance. Many plants can’t even get enough coal, exacerbating electricity shortages, but the government doesn’t want to raise electricity prices, so the dominoes are falling. In December 2011, Infrastructure Development Finance Company stopped financing new coal plants. In February 2012, the Reserve Bank of India said it wouldn’t help banks that got in trouble on new coal-plant loans. (See: “Coal Power Loses Its Luster as Costs Rise.”) Financing dried up. Three weeks later, Tata announced its investment emphasis had shifted from coal projects to wind and solar. Led by four of India’s richest families, India shelved plans for 42 GW of coal plants in the last three quarters of 2012. That’s nearly a fourth of existing total capacity, or 68 percent of the government’s short-term target—only 32 percent of which Coal India says it can fuel. With power-hampered growth threatened by even scarcer or costlier power, some of India’s electricity leaders are seeing their way forward in superefficiency, distributed renewables, and microgrids—and not only in rural areas.

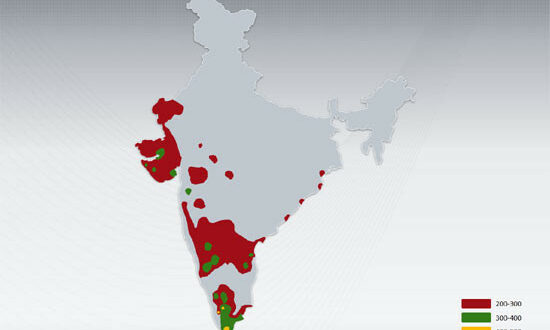

As in China, vibrant private-sector entrepreneurship in renewables should be capable of far outpacing the state-owned industries that dominate coal and nuclear power. India, the world’s #3 windpower market, has already installed nearly four times more wind than nuclear capacity. Solar power too added 1 GW in 2012 and is taking off briskly. And of course India has huge efficiency opportunities because most of its ultimate infrastructure isn’t yet built. Projects like Infosys’s 70-percent-less-energy-using new offices in Bangalore—helped by ASHRAE Fellow and RMI Senior Fellow Peter Rumsey—are gaining wide attention. A constellation of impressive new nongovernmental efforts with businesses and governmental allies is starting to focus India’s energy policy reforms and business mobilizations.

In all, India seems to be at an energy tipping point. It is starting to comprehend its massive efficiency and renewable potential, and enjoys growing private-sector skills to capture that potential, especially if regulatory barriers can be removed. All of this as the power sector—chastened by the world-record summer 2012 blackout of 600 million people—starts to face the need for serious reforms. The main missing elements, as in China and Japan, include rewarding utilities for cutting your bill (instead of selling you more energy), and allowing demand-side resources to compete in supply-side bidding.

Of course, there are major challenges in modernizing a sprawling, disjointed sector with irregular management quality and transparency. But with so many brilliant entrepreneurs and engineers, important advances are already emerging from the bottom up at the firm, municipal, and state levels, whether led or followed by national policy. And as we’ll see in the second part of this blog, all three of Asia’s economic giants will be increasingly informed and perhaps inspired by the example of their European counterpart and prime competitor, Germany, which is now switching to a green electricity system faster than anyone thought possible.

National Geographic

Asia Finance News Asia finance news, banking, market analysis, business, Forex, trade, Cryptocurrency as it is happening in Asia. Trusted gateway for Asian financial news.

Asia Finance News Asia finance news, banking, market analysis, business, Forex, trade, Cryptocurrency as it is happening in Asia. Trusted gateway for Asian financial news.