Online finance has boomed in China over the last year and a half. It started with mutual funds accessible to average citizens, offered by Alibaba, Baidu, and Tencent. Then, a surge in peer-to-peer lending took hold because – like the mutual funds – they also lowered the barrier for individuals to secure personal loans in China. And now a new …

Read More »Finance

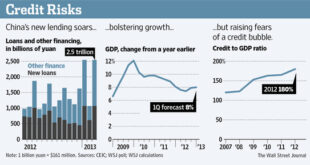

Surge in Loans Puts Beijing in a Quandary

BEIJING—A surge in lending that defied Beijing’s efforts to mop up liquidity presents China’s new leaders with the tough prospect of risking a budding growth revival by cracking down too hard to head off a bad-loan crisis. China has been on a credit binge since the global financial crisis of 2008, initially a deliberate strategy by leaders to finance investment …

Read More »Over regulation of financial market will cause problems in future

SINGAPORE: The head of Singapore’s biggest bank said over-regulation of the financial market will cause problems in coming years. CEO of DBS, Piyush Gupta, said Asian banks do not have the same problems as their global peers in meeting capital and liquidity requirements. Speaking at the sidelines of a banking industry forum on Friday, Mr Gupta said the Asian financial …

Read More »Asian Tigers dump euro

The share of euros in the world’s rising powers’ reserve holdings has fallen to its lowest level since 2002, dashing hopes that the single currency will soon challenge the US dollar for global primacy. International Monetary Fund data show that emerging nations have cut the weighting of EMU bonds in their reserves to 24.7pc from a peak of 30pc at …

Read More »Tasmania looks to Asia to fix economic problems

Tasmanian Premier Lara Giddings says she is looking to Asia to drive the next economic boom after the collapse of the once mighty timber company Gunns. Gunns’ voluntary administration and the closure of the only abattoir on King Island has left more than 200 workers in the island state facing an uncertain future. It has forced Tasmanians to refocus their …

Read More »UPS Issues Commercial Paper Denominated in China’s Renminbi

First Foreign Non-Financial Company To Issue Commercial Paper in Offshore Renminbi Market HONG KONG–(BUSINESS WIRE)– UPS (UPS) has executed a commercial paper transaction denominated in the offshore Renminbi currency, creating a new financial vehicle to fund growth projects in China. The issuance last Friday, known as a CNH-denominated commercial paper transaction, totaled CNH 630,000,000 and is the first by a …

Read More »Asian banks keep financing trade

Asian banks are providing an increasing chunk of trade finance in the region as European banks pull back due to the eurozone crisis and new bank regulations. The push by Asian institutions into the market, suggests that trade finance – estimated at $10tn a year globally and supporting more than 80 per cent of global trade – remains available in …

Read More »Asian firms to hurt as Europe banks cut lending

* Asian banks lack capacity to fill in gap left by Europeans * Low global interest rates may create property bubble in Asia * MAS takes steps to boost Sing dollar corp bond liquidity (Recasts on impact of reduced European bank lending) SINGAPORE, March 14 (Reuters) – European banks will continue to reduce their lending in Asia, posing problems for …

Read More »CIMB Bank aims to approve S$100 mln Islamic loans for SMEs

KUALA LUMPUR: CIMB Bank, which started its Islamic commercial banking operations in Singapore last year, aims to approve S$100 million this year for the small and medium enterprises (SMEs) in the republic. “We are targeting about S$100 million for SME financing this year. “At the moment, we already have about S$30 million on our balance sheet with a healthy pipeline for …

Read More »Chinese banks to hold differentiated housing loans

BEIJING, March 1 (Xinhua) — China’s four biggest state-owned banks said Thursday they will continue implementing the differentiated housing loan policy. The four state-run lenders, dubbed “the Big Four,” are Industrial and Commercial Bank of China, China Construction Bank, Bank of China and Agricultural Bank of China. The lenders said they would stick to the government’s macro control policies over …

Read More » Asia Finance News Asia finance news, banking, market analysis, business, Forex, trade, Cryptocurrency as it is happening in Asia. Trusted gateway for Asian financial news.

Asia Finance News Asia finance news, banking, market analysis, business, Forex, trade, Cryptocurrency as it is happening in Asia. Trusted gateway for Asian financial news.