BEIJING, March 1 (Xinhua) — China’s four biggest state-owned banks said Thursday they will continue implementing the differentiated housing loan policy.

The four state-run lenders, dubbed “the Big Four,” are Industrial and Commercial Bank of China, China Construction Bank, Bank of China and Agricultural Bank of China.

The lenders said they would stick to the government’s macro control policies over the housing market and abide by the principle of making progress while maintaining stability.

They said they would also strive to improve financial services to affordable housing projects and boost sustained, steady and healthy development of the property sector.

The Big Four will roll out reasonable interest rates on mortgages for first home purchases based on the central bank’s benchmark interest rate. They will also finance qualified developers to construct ordinary commercial housing to meet the market demand.

Meanwhile, the banks said they would strongly support the government-engineered affordable housing programs.

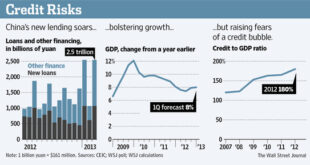

To cool its runaway housing market, China has introduced tightening measures including the differentiated home loan policy.

Under the scheme, bank loans for third home purchases are suspended. First home buyers are required to put down at least 30 percent of the home price to get a loan, while second home buyers have to pay no less than 50 percent as down payments.

The People’s Bank of China, the central bank, said earlier last month that it would continue to carry out a prudent monetary policy this year.

The central bank said it will also keep the differentiated housing loan policy in 2012 and will give more support to the affordable housing projects.

Asia Finance News Asia finance news, banking, market analysis, business, Forex, trade, Cryptocurrency as it is happening in Asia. Trusted gateway for Asian financial news.

Asia Finance News Asia finance news, banking, market analysis, business, Forex, trade, Cryptocurrency as it is happening in Asia. Trusted gateway for Asian financial news.