Singapore is poised to become the Asian centre for synthetic exchange-traded funds, stealing the spotlight from Hong Kong as regulators there become increasingly stringent, according to a report by advisory firm Celent.

The report, published Thursday, highlighted the changing regulatory landscape in Hong Kong and said tougher rules governing synthetic funds in Asia could stunt continued ETF growth in the entire region.

The value of assets under management in Asian ETFs rose in seven out of the last eight years, shrinking only during the financial crisis in 2008.

To date, Hong Kong has been a leading hub where foreign investors use synthetic funds to access markets in which they cannot invest directly.

But regulatory changes by Hong Kong’s Securities and Futures Commission, have made rules more stringent than Europe’s Ucits requirements, and are starting to drive key players to greener pastures.

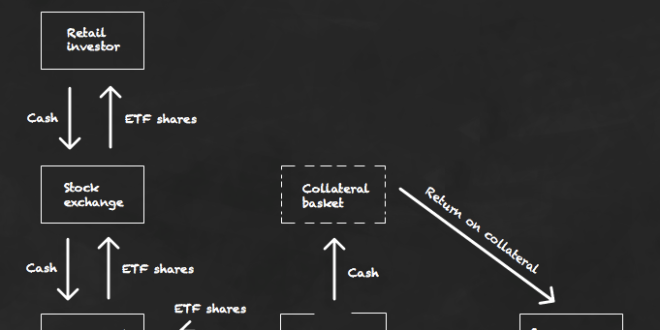

Synthetic funds are considered more risky because, unlike physical ETFs, they do not invest directly in underlying assets. They comprise 11% of the Asia-Pacific ETF market, compared to Europe, where they form 37% of the ETF market, according to Celent.

Issues of risk distribution and assessment as well as transparency and the overall impact the funds could have on the global market have led the SFC to crack down on synthetic funds, changing collateral requirements and transparency rules.

Regulator the Hong Kong Monetary Authority ruled that synthetic ETFs should be identified with an ‘X’ in order to warn investors of the additional risks posed.

Anshuman Jaswal, senior analyst at Celent said: “Hong Kong and Singapore have been the leading markets for synthetic ETFs in Asia. However, regulatory intervention in Hong Kong and the possibility of new rules in Singapore mean that the Asian market might struggle to grow at the same pact in the future.”

ETFs focused on the Asia-Pacific region managed $138bn at the end of August 2011, a 25% increase from the previous year.

Despite fears that growth of synthetic ETFs in Hong Kong will halt, there are still some signs of life. Earlier this month, Enhanced Investment Products Limited became the first domestic firm to gain approval to list synthetic ETFs on the Hong Kong stock exchange. Its suite of swap-based ETFs will be listed on February 16.

Source: Financial News

Asia Finance News Asia finance news, banking, market analysis, business, Forex, trade, Cryptocurrency as it is happening in Asia. Trusted gateway for Asian financial news.

Asia Finance News Asia finance news, banking, market analysis, business, Forex, trade, Cryptocurrency as it is happening in Asia. Trusted gateway for Asian financial news.