SINGAPORE: The head of Singapore’s biggest bank said over-regulation of the financial market will cause problems in coming years. CEO of DBS, Piyush Gupta, said Asian banks do not have the same problems as their global peers in meeting capital and liquidity requirements.

Speaking at the sidelines of a banking industry forum on Friday, Mr Gupta said the Asian financial crisis in the late 90s taught them to control bad loans and keep adequate cash reserves.

However, he added that Asian economies cannot grow unless companies have access to funds.

Mr Gupta said: “Our Basel 3 fully phased-in core tier one requirements are about 11.8 per cent, so it is not an issue. But if you fast-forward five years, for the region as a whole, our own estimates are that the region is short of capital somewhere between a quarter of a trillion to a trillion dollars.

“That will prove a serious challenge to Asia as it wants to step up its growth, step up its investment in infrastructure, and scale up the pace of overall economic activity.”

Mr Gupta also commented on the impact if the recent initiatives announced by the Singapore government as part of Budget 2013. He said Singapore’s focus on taxing the super-rich and talk of limiting foreign workers will not hurt DBS’s wealth management business.

“Singapore is a very attractive place from a tax standpoint, so if your marginal tax rate moves up a percentage point or two it does not materially change the tax situation,” he added.

“Singapore has a lot of other things going for it — infrastructure, rule of law, language — so it’s a very attractive destination for capital flows and wealth flows. We frankly see this continuing to be a big part of our growth agenda.”

DBS was voted Asia’s safest bank for a fifth year by Global Finance. Mr Gupta said being safe does not mean ignoring investment opportunities, but it cannot be sacrificed for quick profits.

He said: “For us being safe and sound and secure is a priority. Frankly, that’s a large part of what Singapore stands for and what DBS stands for, so we’re fairly proud of that.

“Having said that, we believe that we can be safe and still do a lot of things that make us innovative, that make us relevant to our customer base. And frankly, our trajectory in terms of growth of our business over the last three or four years demonstrates that you can do both.”

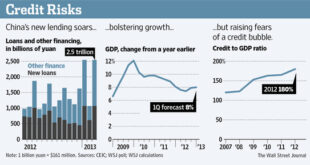

DBS is also growing its renminbi trade in Taiwan, Hong Kong and Singapore. Mr Gupta said doing business in the Chinese currency will be a core profit driver in coming years.

“We have a view that the renminbi will open up more, liberalise more. And all over Asia, you will start to see the renminbi as a unit of account and an instrument of trade. Already in Hong Kong, the renminbi business is about a quarter of our business and that’s quite profound given that three years ago, it was zero.

“So we see the renminbi beginning to have a meaningful role in all the activities in our region. It’s difficult to put a percentage on it but quite clearly the direction is one way.”

-CNA/ac

Asia Finance News Asia finance news, banking, market analysis, business, Forex, trade, Cryptocurrency as it is happening in Asia. Trusted gateway for Asian financial news.

Asia Finance News Asia finance news, banking, market analysis, business, Forex, trade, Cryptocurrency as it is happening in Asia. Trusted gateway for Asian financial news.